This week’s crypto calendar is packed with major events and bullish stories, including the potential approval of Ripple’s Stablecoin, XRP overthrowing BNB with a $100 billion market cap, XLM’s 50% surge following a Grayscale Stellar Lumens Trust filing, and FIFA’s new NFT game.

Additionally, Binance has delisted eight altcoin trading pairs from its spot market, while MicroStrategy is planning to add more Bitcoin to its portfolio. Here are the top crypto news this week:

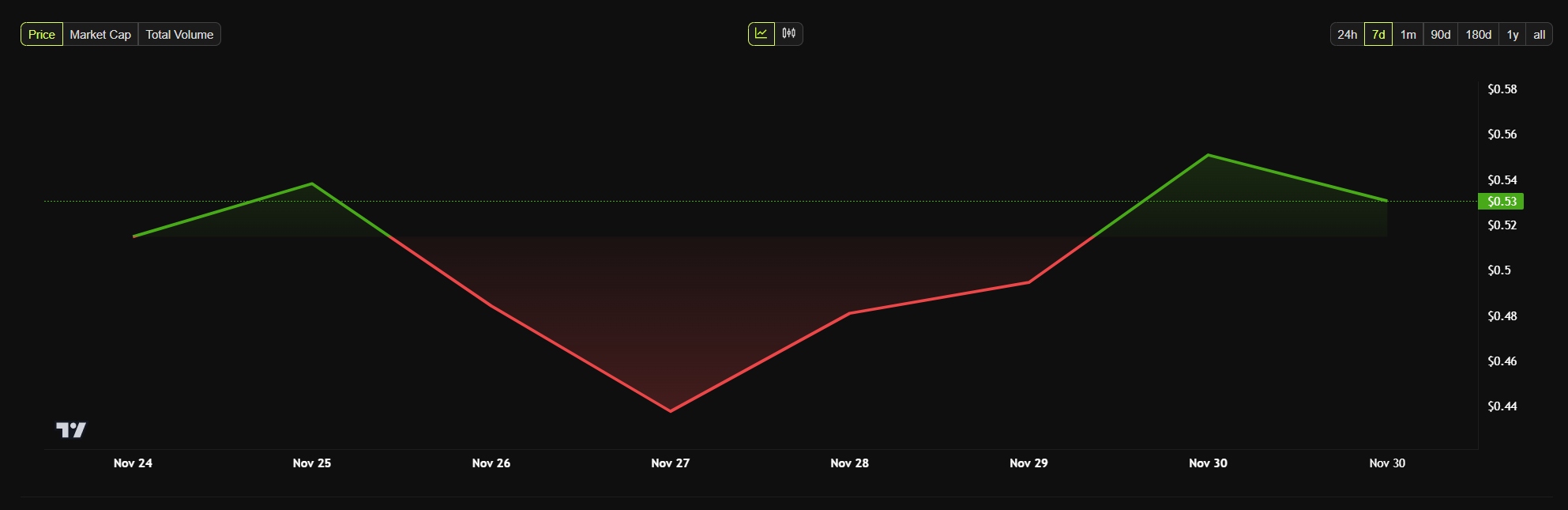

Grayscale Filing Boosts Stellar Lumens (XLM) Price by 58%

Stellar Lumens (XLM) surged by 58% this week, reaching $0.53—its highest price since 2021. This sharp increase follows a 10-K filing from Grayscale Investments for its Stellar Lumens Trust. The filing, submitted on November 23, detailed a 10% growth in the trust’s net assets over the last fiscal year.

A 10-K filing provides detailed financial information and risk factors for publicly traded companies. The positive sentiment surrounding the filing likely fueled the strong market response for XLM.

“Stellar recently broke and closed above a key weekly horizontal resistance. Retesting the broken structure, the price broke a resistance line of a falling wedge pattern on a 4H time frame. It indicates a strong bullish potential and a highly probable coming-up movement. I expect a growth at least to 0.6 level,” popular crypto enthusiast Andrew Griffiths wrote on X (formerly Twitter).

Ripple Stablecoin Approval Expected by December 4

Ripple is preparing to launch its regulated stablecoin, RLUSD, pending approval from the New York Department of Financial Services (NYDFS). As BeInCrypto reported, the stablecoin will likely debut on December 4, marking Ripple’s entrance into New York’s regulated digital finance market.

This move puts Ripple in direct competition with stablecoin issuers like Circle and Paxos. Partnerships with platforms such as Bitstamp and Moonpay aim to ensure broad accessibility for RLUSD users.

Meanwhile, Ripple’s XRP token surpassed BNB in market cap, crossing the $100 billion mark for the first time in three years. XRP’s value has risen over 230% this month amid growing investor optimism.

Binance Delists Eight Altcoin Trading Pairs

Another top crypto news this week is that Binance announced plans to delist eight altcoin trading pairs on December 10. This will include GFT/USDT, IRIS/BTC, IRIS/USDT, KEY/USDT, OAX/BTC, OAX/USDT, REN/BTC, and REN/USDT. The exchange cited periodic performance reviews and low liquidity as reasons for the delistings.

Prices for affected tokens, including GFT and OAX, dropped nearly 30% following the announcement, reflecting investor concerns over their future viability. Binance advises users to adjust their holdings before the removal date.

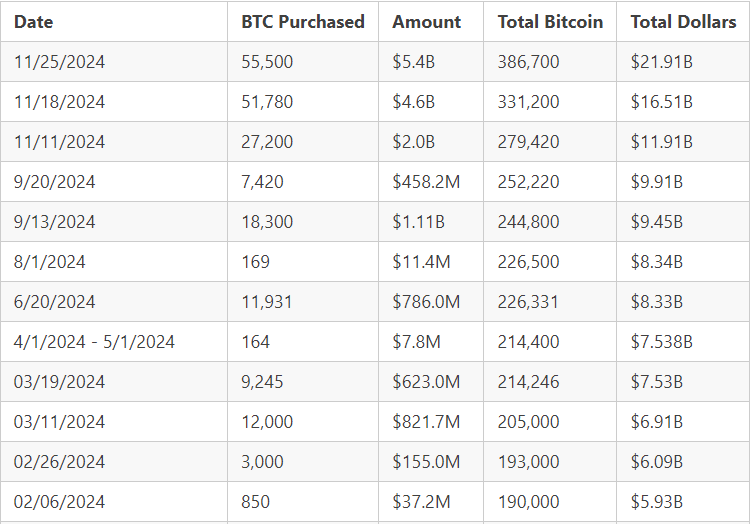

MicroStrategy Eyes Bitcoin Purchases with $3 Billion Funding

MicroStrategy co-founder Michael Saylor hinted at new Bitcoin acquisitions after the company secured $3 billion through convertible debt issued on November 22. The notes, offered privately to institutional investors, will mature in 2029 and carry a premium strike price of $672 per share.

Meanwhile, MicroStrategy remains the largest corporate Bitcoin holder. The company currently holds 386,700 BTC worth over $37.5 billion. Saylor’s comments suggest the company may continue its aggressive Bitcoin strategy.

FIFA to Launch NFT-Powered Football Game

As BeInCrypto reported, FIFA has partnered with Mythical Games to develop FIFA Rivals, a mobile football game expected to launch in mid-2025. Players can create and manage football clubs and compete in real-time matches.

“FIFA Rivals is designed to be highly accessible, featuring a shallow learning curve coupled with advanced features for hardcore players to explore. The partnerships we have with both the NFL and with FIFA should open the door for other collaborations between web3 games studios and major sports titles,” Nate Nesbitt, spokesperson for Mythical Games, told BeInCrypto.

The game will include an NFT marketplace, allowing players to trade football stars as digital collectibles. Mythical Games aims to replicate the success of its NFL Rivals title by integrating NFTs into FIFA Rivals.

Chirp Introduces DePIN Play-to-Earn Game

Chirp, operating on the Sui blockchain, launched Kage, a play-to-earn game combining entertainment with real-world utility. Players use their smartphones to detect nearby wireless networks, earning CHIRP tokens for their activity.

As the first game to integrate DePIN (Decentralized Physical Infrastructure Networks), Kage highlights the growing trend of blockchain-based P2E models offering real-world applications.

Finally, all eyes will be on Bitcoin, as it remains within striking distance of the $100,000 mark. Despite the brief corrections, BTC has consistently hovered around $97,000. It will be interesting to see BTC finally reach six figures ahead of Christmas. These were the top crypto news this week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.